NETS for you

Support

Filter by Category

Top Questions

The NETS Motoring Card will replace the current CashCard. Please note that the NETS Motoring Card can only be used in the 2nd Generation In-Vehicle Units (2GIU) and the future On-Board Unit (OBU). If you have a first generation IU, you can only use the CashCard.

The NETS Motoring Card also offers the following features:

- Auto Top-Up

- Enable auto top-up with your credit/debit card as your source of funds and never worry about insufficient card value again

- Contactless Functionality

- For car park readers that do not support automatic fee deduction, you can now simply tap and hold your NETS Motoring Card on the carpark reader instead of having to insert your card

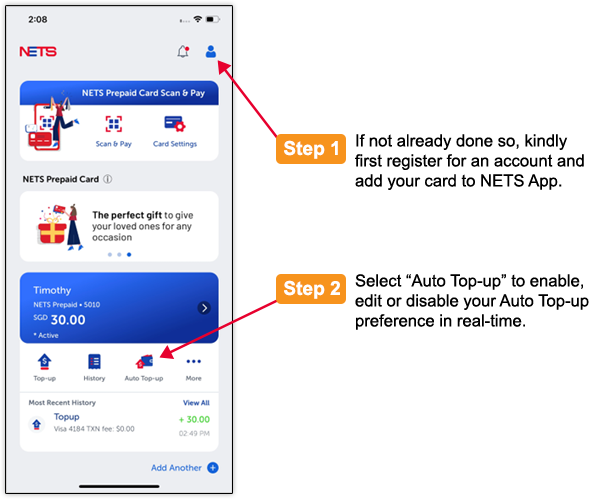

- NETS App

- The NETS Motoring Card comes with a supporting mobile app which allows you to check your card balance and expiry, view your transaction history, perform top-ups and apply for Auto Top-Up.

- Exclusive privileges and benefits (terms and conditions apply):

- WINK+ points with ERP payments

- Free card insurance by HL Assurance

The NETS Motoring Card is available at $10 per card ($5 card cost + $5 stored value) and can be purchased from all petrol stations and convenience stores.

Yes, the NETS FlashPay Card is valid for use for 7 years from the date of card encoding.

- NETS App via Google Play Store or Apple App Store*

- NETS Customer Service Centre

- NETS Top Up Machines

- Add Value Machine Plus (AVM+)

- General Ticketing Machines (GTM)

- Local bank ATMs (DBS/POSB, OCBC and UOB)

- 7-Eleven stores*

- Buzz Pods*

- Cheers*

- FairPrice Xpress*

- TransitLink Ticket Office*

*A service fee may be chargeable.

To obtain a refund on the remaining card value in your NETS FlashPay Card, you may file the refund at the following channels:

- You may perform a refund of the remaining stored value in the card at any local bank ATM. This amount will be credited directly to your bank account; or

- You may obtain an immediate cash refund at any TransitLink Ticket Office. This is only applicable for remaining balances of no more than $100 per card; or

- Alternatively, you may visit the NETS Customer Service Centre for refunds.

Please note that your card will be cut up and retained when you submit it for deferred refund. You’ll need to notify your bank should you require any replacement card or to cancel your account before submitting the card for refund.

You will need to de-register the Auto Top-Up service on your NETS FlashPay Card at selected NETS Top-Up Machine or NETS Customer Service Centre.

For NETS Top-Up Machines with de-registration function available, please select “Auto Top Up” on the terminal menu, followed by “De-registration”.

If you do not intend to continue to use the NETS FlashPay Card, you may perform an online refund of the remaining stored value in the Card, 21 working days after de-registration at any local bank ATM.

- You may de-register the Auto Top-Up service at any NETS Top Up Machines or NETS Customer Service Centre.

- You may then perform a refund of the remaining stored value in the card at any local bank ATM after 21 working days. This amount will be credited directly to your bank account; or

- You can obtain an immediate cash refund at TransitLink Ticket Office. This is only applicable for remaining balances of not more than $100 per card; or

- Alternatively, you may submit your Auto Top-Up enabled card for deferred refund at the TransitLink Ticket Office or NETS Customer Service Centre.

- The remaining stored value and Auto Top-Up deposit (if any) will be credited to your account within 21 working days upon receipt by NETS.

Please note that your card will be cut up and retained when you submit it for deferred refund. You’ll need to notify your bank should you require any replacement card or to cancel your account before submitting the card for refund.

The card is available online and at several NETS official distributors. Please visit our NETS Prepaid Card page for an updated list of our distribution points, partners and promotions.

Each card is sold at $10 (inclusive of $5 stored value) at convenience stores and other outlets. The cost of the card is $5 and is non-refundable.

- NETS Top-up Machines

- Any DBS/POSB, OCBC or UOB ATM

- 7-Eleven*

- Cheers*

- FairPrice Xpress*

*A service fee may be chargeable

You may check and print the transaction history of your NETS CashCard at:

- Any DBS/POSB, OCBC or UOB ATM (up to the last 10 transactions)*

- NETS Self-Service Station

- NETS top-up terminals (up to the last 25 transactions)

*Please note that a $ 0.20 (GST inclusive) service fee is charged for a printout of the NETS CashCard transaction history at ATMs.

If you have a dual-mode IU, you may wish to consider switching to the new NETS Motoring Card if you are still using the NETS CashCard for your ERP and car park payments. The NETS Motoring Card is compatible with current dual-mode IU and future on-board unit (OBU) which will be introduced soon for the next generation ERP system. You can find more information from the NETS Motoring Card page.

If you are still using a first generation IU, you can purchase a NETS CashCard from the NETS Customer Service Centre (351 Braddell Road #01-03 Singapore 579713) during operating hours 8:30am to 5:30pm (Mon– Fri except Public Holidays). With effect from 2 May 2024, please note that the sale of the NETS CashCard is limited to one per customer.

NETS CashCard can hold a maximum of $500 in stored value.

If you experience problems with your NETS CashCard, please call the NETS Customer Service Hotline at 6274 1212 for assistance.

Yes, the NETS CashCard is valid for use for 5 years from the date of card encoding. The card is valid for a full refund within 2 years from the date of expiry. Subsequently, a service fee of $1 per month is deducted from the stored value.

You are entitled to a full refund of the remaining stored value in the NETS CashCard within 2 years after the validity period.

If your NETS CashCard has expired for more than 1 calendar year after the Validity Period, NETS shall be entitled to levy a service charge of S$1.00 per month or such other amount as NETS may determine from time to time, such levy to be deducted monthly from the Stored Value commencing the month after the end of the two years until the Stored Value is fully depleted, or until the 84th calendar month (7th calendar year) from the date of card encoding, whichever is the earlier.

If the card is not faulty, an immediate refund can be made at any DBS/POSB, OCBC and UOB ATM.

You may also send in your card for refund at DBS, OCBC and UOB bank branches or visit NETS Customer Service Centre.

Your CashCard can no longer be used once the card has been refunded.

The NETS CashCard is deemed non-retrievable once misplaced. There is no refund for lost and/or stolen NETS CashCards.

The First Gen IU is only compatible with the NETS CashCard. Given that the First Gen IU numbers have been decreasing over the years and with On-Board Unit (OBU) migration underway, the need for NETS CashCard has been reduced. Therefore, with effect from 2 May 2024, the sale of the NETS CashCard is limited to one per customer.

If your vehicle is currently fitted with the 2nd Gen IU or the new On-Board Unit (OBU), you may continue to use your NETS Motoring Card. Alternatively, you may buy NETS Motoring Card from these retailers.

For more information on the OBU migration, you may visit LTA’s website.

As we have limited NETS Cashcard available, we are restricting the sale of the cards to ensure drivers with first generation IU have the opportunity to purchase the cards when their cards expire.

For customers with 2nd Gen IU or On-Board Unit (OBU), you may purchase the NETS Motoring Card instead.

Please note that the lifespan of the NETS CashCard may exceed the OBU Migration exercise. Should there be any balance amount in your valid NETS CashCard, an immediate refund can be made at any DBS, POSB, OCBC and UOB ATMs.

Please find the list of locations here.

NETS Top-up Machines allow you to perform the following functions* for your NETS FlashPay, CashCard and NETS Motoring Card:

- Top-Up

Top up using your NETS bank cards

- Auto Top-Up

De-register your Auto Top-up functionality

- Balance Enquiry

Check your remaining card balance

- Credit Rebate

Receive funds for faulty cards/disputed transactions

- Statement Reprint

Print your transaction history:

- CashCard: Max. 25 transactions

- NETS FlashPay/ NETS Motoring Card: Max. 30 transactions

- Prepaid Top-Up

Top up your prepaid Mobile SIM card (Starhub/M1/Singtel)

*Please note: As the type of terminal within the machine differs, not all of the above listed functions may be available. Please refer to the menu displayed on the terminal screen to check for available functions.

eNETS

eNETS

All Questions

You may have entered an incorrect credit card number, CVV or Expiry Date.

If you have made payment for the wrong product, please contact the merchant directly.

You will receive an email confirmation upon successful payment, and you will be led to a page with a “Transaction Successful” notification.

The transaction should also display in the transaction history of your card used for purchase. You may check your transaction history through ibanking or via ATMs.

An email will be sent to your email address if the transaction is successful and you will be led to a page, which shows “Transaction Successful.” If you experience any issues, you may contact the NETS Customer Service Hotline at 6274 1212 or email info@nets.com.sg.

Most pop-up blockers allow you to either selectively allow pop-ups from some sites or temporarily disable their function altogether. We recommend that you selectively allow pop-ups from the following sites (domain).

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg(For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- standardchartered.com.sg (For Standard Chartered Account holders)

Instructions for configuring the most common pop-up blockers are provided below. However, with virtually hundreds of pop-up blockers on the market today it is impossible to provide an all-inclusive manual. For instructions on other pop-up blockers, please refer to your pop-up blocker manufacturer’s manual.

Notes:

- In many cases there is more than one pop-up blocker installed on your computer. This being the case, you’ll need to configure all of them.

- Other examples of pop-up blockers may be named “Ad Blocker” or “Window Killer”, etc.

- Sometimes a blocker may be installed even without your knowledge (this is called “Spam”).

- Open Internet Explorer.

- Click Tools in the upper toolbar.

- Click Internet Options.

- Select the Privacy tab.

- Click Settings under “Pop-up Blocker”

- In the input field for “Address for website to allow” indicate “www.enets.sg” and click Add button. The website will be displayed in “Allowed sites” box.

Please also add the relevant bank’s sites to your list of allowed sites if you are using the DBS/POSB, OCBC, UOB, Citibank and/or Standard Chartered Bank Internet banking facilities to make your payment. Otherwise, the relevant transaction pages will not be displayed and the transaction request will not be processed.

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg (For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- standardchartered.com.sg (For Standard Chartered Account holders)

Click Close and OK to apply the new settings.

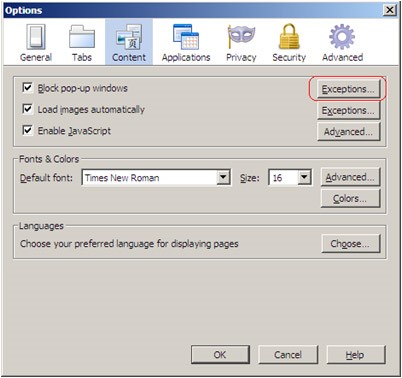

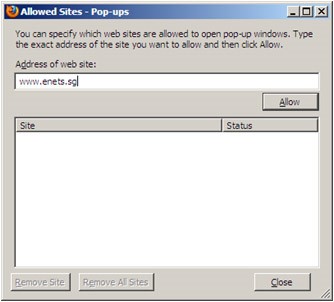

- Open Firefox.

- Click Tools in the upper toolbar.

- Click Options.

- Select Content icon.

- Click Exceptions beside the “Block pop-up windows” checkbox.

6. In the input field for “Address of web site” indicate “www.enets.sg” and click Allow The website will be displayed in dialog box.

Please also add the relevant bank’s sites to your list of allowed sites if you are using the DBS/POSB, OCBC, UOB, Citibank and/or Standard Chartered Bank Internet banking facilities to make your payment. Otherwise, the relevant transaction pages will not be displayed and the transaction request will not be processed.

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg (For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- standardchartered.com.sg (For Standard Chartered Account holders)

Click Close and OK to apply the new settings.

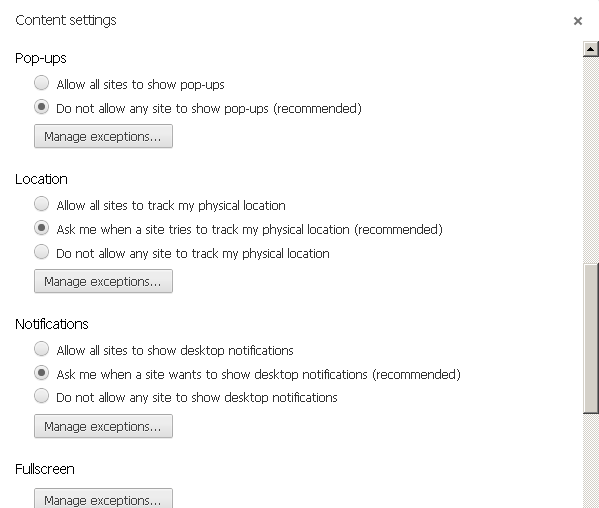

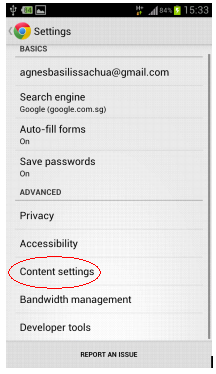

- Open Chrome.

- Click the menu button

.

. - Click Settings > Click Show Advanced Settings.

- Click Content settings under Privacy section.

- Scroll down to Pop-ups section > Click on Manage Exceptions.

6. In the input field for “Pattern” indicate “www.enets.sg”, select click “Allow” under the Action dropdown list and click OK.

Please also add the relevant bank’s sites to your list of allowed sites if you are using the DBS/POSB, OCBC, UOB, Citibank and/or Standard Chartered Bank Internet banking facilities to make your payment. Otherwise, the relevant transaction pages will not be displayed and the transaction request will not be processed.

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg (For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- standardchartered.com.sg (For Standard Chartered Account holders)

Click on Close buttons until you return to Chrome to apply the new settings.

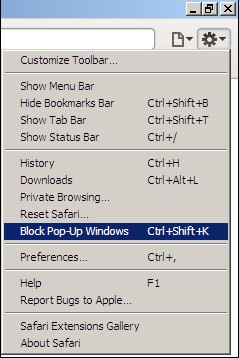

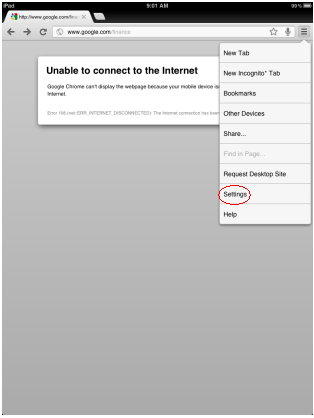

- Open Safari.

- Click Gear menu

.

. - Uncheck “Block Pop-Up Windows”.

Note: There is no way to selectively disable the pop-up blocker in Safari. Please check “Block Pop-Up Windows” again after you complete the payment.

- Click on Google Toolbar’s Pop-up Blocker button while at www.enets.sg website and check “Always allow pop-ups from enets.sg”.

Please also add the relevant bank’s sites to your list of allowed sites if you are using the DBS/POSB, OCBC, UOB, Standard Chartered and/or Citibank Internet banking facilities to make your payment. Otherwise, the relevant transaction pages will not be displayed and the transaction request will not be processed.

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg (For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- ibank.standardchartered.com.sg (For Standard Chartered Account holders)

1. Turn off Pop-Up Blocker by clicking the Pop-Up Blocker menu and uncheck Enable Pop-Up Blocker.

2. Press and hold the CTRL key while clicking a link to override Pop-Up Blocker and allow any pop-up windows resulting from the click.

3. Add the source of the pop-up window to your Allowed List by clicking the Pop-Up Blocker menu and selecting ‘Always Allow Pop-Ups From’. Then select the site from the Sources of Recently Blocked Pop-Ups list and click Allow.

If you are making payment by eNETS and using the DBS/POSB, OCBC, UOB, Standard Chartered and/or Citibank Internet banking facilities, please add the following sites to your list of allowed sites. Otherwise, the relevant transaction pages cannot be displayed, and your transaction request cannot be processed.

- enets.sg

- dbs.com (For DBS/POSB Account holders)

- uob.com.sg (For UOB Account holders)

- citibank.com.sg (For Citibank Account holders)

- ocbc.com (For OCBC Account holders)

- plus.com.sg (For Plus! Account holders)

- standardchartered.com.sg (For Standard Chartered Account holders)

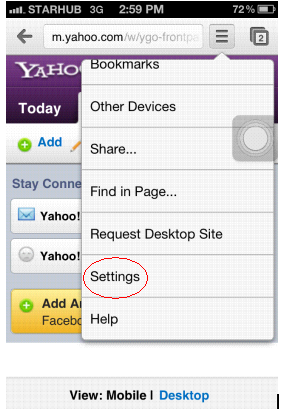

If Safari Pop-Up Blocker is blocking something you want to see, there is an option which you can disable the Pop-Up.

- Go into settings of iPhone 4S and tap on Safari.

- Scroll down and turn OFF the Block Pop-Ups option.

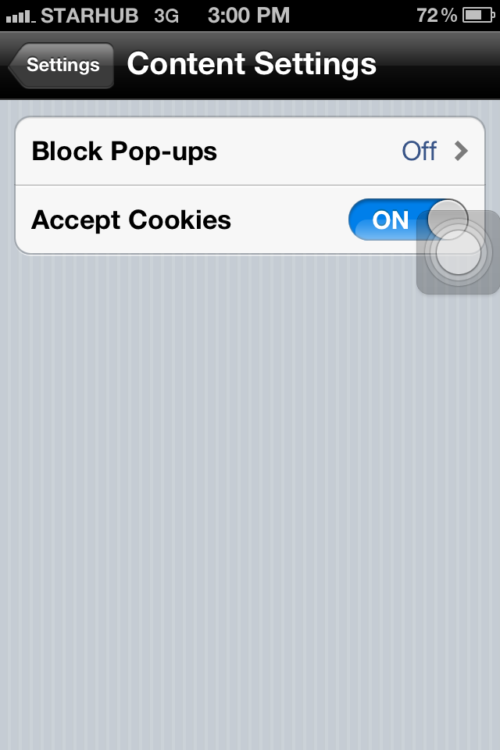

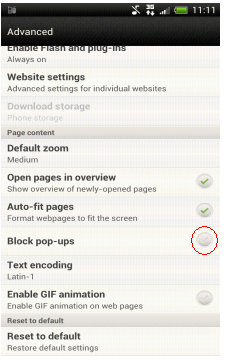

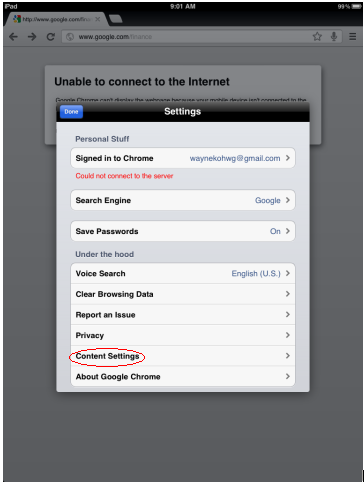

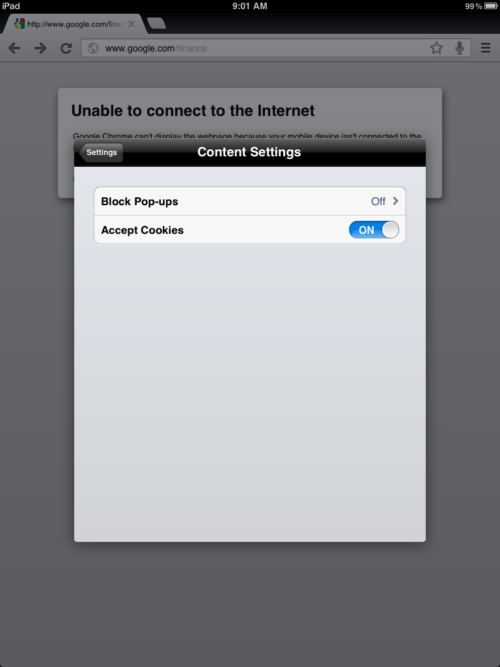

1.If the Pop-Up Blocker is blocking something you want to see, there is an option which you can disable the Pop-Up.Go into Google Chrome of iPhone 4S, select the menu button and choose Settings.

2. In the Settings, select Content Settings.

3. In the Content Settings, turn Off Block Pop-ups.

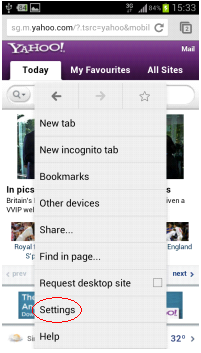

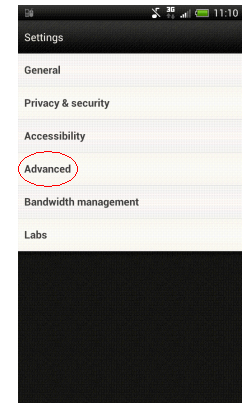

1. Open Internet browser of Samsung Galaxy S3.

2. Click on the menu button of the phone.

3. Scroll down to select Settings.

4. In the Settings option, select Advanced.

- Open Google Chrome of Samsung Galaxy S3, press the menu button of the phone.

- Click the Settings option in the menu.

- In The Settings, select Content Settings.

- In the Content Settings, remove tick of Block Pop-ups option.

- Go into the Menu of Internet browser of HTC Desire HD phone and select Settings.

- In the Settings, scroll down and select Advanced.

- In the Advanced page, scroll down and remove tick of Block pop-ups.

- Tap on the Google Chrome menu button then go into Settings.

- In the Settings, go into Content Settings.

- In the Content Settings, choose to OFF Block Pop-ups.

NETS App

NETS App

All Questions

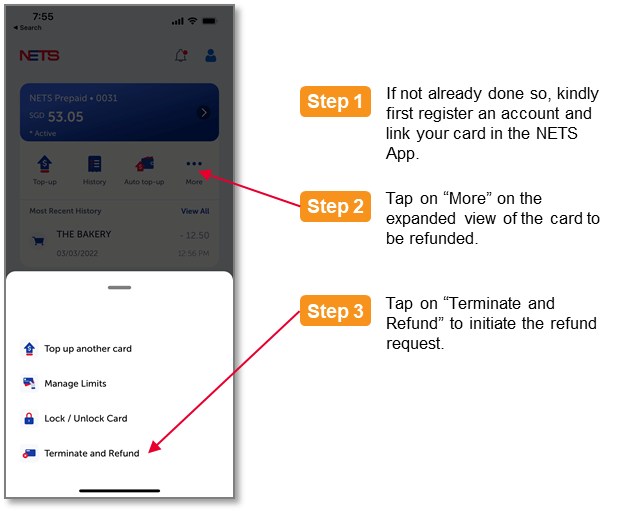

NETS App is an Android and iOS application that allows you to perform the following NETS Motoring Card transaction using your mobile device:

- Motoring Top Up*

- Motoring Auto Top-Up (ATU) registration

- Motoring Auto Top-Up Activation

- Balance Enquiry

- Card Expiry Enquiry

- Transaction History

*Top-up fee applicable

You can use your NETS Account to sign in to the NETS App.

The NETS App replaces the NETS FlashPay Reader App. More services are coming soon to the NETS App.

Please open the NETS App on your mobile device and go to the sign-in page.

If you have forgotten your password, please select “Forgot Password” and follow the instructions to reset your password.

If you have forgotten your email address (used as your user ID), please select “Forgot Email” and follow the instructions to recover your email address.

You are not required to sign in to the NETS App if you wish to do a one-time top-up of your NETS FlashPay Card or the NETS Motoring Card.

The NETS App can be found on the Google Play Store or Apple App Store.

After installation, you can launch the NETS App in 2 ways:

- For iOS users, you can locate the NETS App icon in your mobile device and launch it.

- For Android users, you can locate the NETS App icon in your mobile device and launch it. If NFC is not enabled, a prompt will appear to enable NFC. Select ‘Yes’ and your phone settings menu will launch for you to enable NFC. Alternatively, if your phone is NFC enabled, place the card against the back of your phone where the NFC antenna is located, the NETS App will launch automatically once it reads the NETS Motoring Card.

1. Top Up

- Upon launching the NETS App, select ‘Top-Up’ under NETS FlashPay, Motoring Card.

- You will be prompted to hold your NETS Motoring Card against the back of your mobile device to begin

- Next, select the preferred amount for top-up

- Proceed to key in your preferred credit/ debit card for the top-up transaction.

- Enter the OTP to authorize the payment

- You will be prompted to hold your NETS Motoring Card against the back of your mobile device to complete the Top-Up.

2. Auto Top-Up registration

Please have your NETS Motoring Card with you and follow the steps below to register ATU via the NETS App:

- Upon launching the NETS App, select ‘Auto Top-Up’ under NETS FlashPay, Motoring Card

- Select “Auto Top-Up Registration”

- Complete the form with your preferred credit/debit card details and NETS Motoring Card CAN number

- Proceed to ‘Submit’

3. Auto Top-Up Activation

Please follow the steps below to activate ATU via the NETS App:

- Upon launching the NETS App, select ‘Auto Top-Up’ under NETS FlashPay, Motoring Card

- Select “Auto Top-Up Activation”

- Enter the 6-digit ATU activation code sent to you via SMS or email

- Proceed to “Activate”

- ‘ATU Activation Successful’ message will be displayed once ATU activation is completed.

4. Card Enquiry

You may do the following enquires using NETS App.

- Balance Enquiry

- Card Expiry Enquiry

- Transaction History

Please follow the steps below to make the enquiries:

- Upon launching the NETS App, select more ‘…’ under NETS FlashPay, Motoring Card

- Select “Card Profile”

- You will be prompted to hold your NETS Motoring Card against the back of your mobile device to begin

- You will be able to read your NETS Motoring CAN number and expiry date.

- Select back ‘<’ at the top left hand corner and you will be able to read your balance and see recent transaction history.

- Select ‘History’ if you wish to see past transactions.

1. iOS Users

You may wish to try placing your NETS Motoring Card (vertically) behind the top edge of your iPhone to find a better connection with your iPhone’s NFC antenna.

2. Android Users

You may wish to try placing your NETS Motoring Card behind the centre of your Android phone to find a better connection with your phone’s NFC antenna. Otherwise, try placing behind the top or bottom of your phone as different phone models may have their NFC antenna set-up differently.

Android mobile devices will be required to run Android 5.0 or later. iOS mobile devices will be required to run iOS 9 to download NETS App. In order to read the NETS Motoring Card via the Near Field Communication (NFC), iOS mobile devices model must be iPhone 7 or latest and running on iOS 13 or later.

We recommend the removal of the mobile device rear case cover (which may cause interference) before reading the Motoring Card.

Rooted mobile devices will not be able to perform transactions on the NETS App due to security concerns.

You can re-launch NETS App and place your NETS Motoring Card firmly against the back of your mobile device. If there are any funds that were not successfully topped up previously, NETS App will automatically proceed to top up the card.

If the payment page does not direct you back to the success message on the homepage, you can re-launch the NETS App to enquire your NETS Motoring Card to see if any funds have been loaded onto your card. If there is no top-up, there should not be any deductions made from your credit/debit card account. Alternatively, you may wish to contact the issuing bank of your credit/debit card to confirm.

For customers who top-up using local-issued DBS/POSB and UOB Visa/MasterCard credit/debit card, the convenience fee will be waived. However, a convenience fee of S$0.25 (GST inclusive) is applicable on local-issued OCBC Visa/MasterCard credit/debit card and a convenience fee of $0.50 (GST inclusive) is applicable on any other applicable Banks’ card for every successful Auto Top-Up transaction.

Currently, the top-up service accepts all Mastercard, Visa and AMEX cards issued in Singapore and Malaysia.

Only locally-issued Mastercard from DBS/POSB, OCBC, UOB, HSBC, BOC, SCB and Maybank are eligible. For Visa, only locally issued DBS/POSB, UOB, HSBC and BOC cards are eligible.

You can perform up to three (3) top-up transactions on the same day. And up to twelve (12) top-up transactions in a week for your NETS Motoring card.

For credit card security reasons, the same credit or debit card can only be used up to ten (10) top-up transactions and no more than thirty-five (35) top-up transactions a week.

You may try to re-launch your NETS App and place your card firmly against the back of your mobile device to update your card. Alternatively, you may attempt to perform the top-up on another device.

Should the value of your card was not updated and your credit/debit card was deducted, you may contact NETS Customer Service Hotline at 6274 1212 or email info@nets.com.sg to verify your transaction(s).

You are required to provide your NETS Motoring Card CAN (16-digit number printed on the back of your card), the first four and last four digits of your credit/debit card (for e.g. 5569-xxxx-xxxx-1234), the top-up amount, the approximate transaction date, transaction time and your contact details such as email and contact number for transactions verifications.

NETS Bank Card

NETS Bank Card

Filter by Category

All Questions

For HSBC Visa Debit Card, PAssion POSB Debit Card, Maybank Mastercard Debit Card and all ATM cards, customers can apply or request for replacement from the respective banks.

For Visa Debit Cards issued by DBS, OCBC and UOB, customers may use their existing cards to tap for NETS contactless payment without any need to upgrade or perform any activation action.

Simply inform the cashier that you would like to pay by NETS and wait for the cashier to give you the cue to tap. Tap your contactless NETS Bank Card on the payment terminal to complete the transaction.

For transaction amount that is above $100, you will be prompted to key in your 6-digit card PIN after tapping your contactless NETS Bank Card.

Consumers can use NETS contactless feature for purchases under SGD$100 per transaction. For amounts greater than that, the terminal will prompt for PIN.

Every contactless card contains a highly sophisticated, highly secure chip. This chip performs a wide range of functions to maintain the card’s security, and can interact securely with a contactless terminal.

SimplyGo is an LTA and TransitLink initiative to introduce contactless payments on trains and buses. ‘SimplyGo’ brings more ease and convenience by giving commuters more e-payment options in transit.

SimplyGo enables commuters to use cards with contactless function for fare payments. There will be no need for upfront top-ups. For NETS Bank Card users, train and bus fares will be deducted from their bank accounts. For credit and debit card users, the fare payment will be charged to their credit or debit card.

Furthermore, commuters can sign up for a SimplyGo account and register their bank cards, debit or credit cards, to have access to their travel history and transactions via the TransitLink SimplyGo Portal or TL SimplyGo mobile app, anytime, anywhere, regardless of the card they choose to use on transit.

NETS Bank Cards with NETS contactless icon is compatible with SimplyGo.

You can get a contactless NETS Bank Card from participating bank branches.

You may visit the TransitLink SimplyGo Portal or download the TL SimplyGo mobile app to register for a SimplyGo account. You will be required to create a password to login to your account. Please login to your account and go to “My Cards” page to add your contactless NETS bank card. For Singtel Dash users, please key in your 16-digit Transit Card Number found in the “Train/Bus” tab of the app.

A password self-reset feature is available on the login page of the TransitLink SimplyGo Portal or TL SimplyGo mobile app.

With a SimplyGo account, commuters can enjoy the convenience of viewing their travel expenditure and history on the go. Registered users of NETS Tap Bank Card can also opt to receive push notifications for travel fares and claim approvals using the TL SimplyGo mobile app on their smartphones. Other services include submitting travel claims and viewing of claim status, as well as making payment for penalty fees.

Commuters who face issues at the point of boarding and alighting can approach officers at the Passenger Service Centre or Bus Captains for assistance. Commuters may wish to contact the Issuing Bank if they encounter difficulties using a specific bank card.

More information is available at the TransitLink SimplyGo Portal. For other enquiries, please call the TransitLink Hotline at 1800-2255 663.

Similar to tapping your current travel card on MRT fare gates and bus card readers, you just need to tap your contactless NETS Bank Card at the point of boarding and alighting for buses, and when entering and exiting MRT stations.

You can only use one contactless payment card (Mastercard, VISA, EZ-Link, NETS FlashPay or NETS Bank Card) at a time. Please remember to take out the card you intend to use from your wallet or bag and tap it on the fare device to enter and exit the MRT station, and when boarding and alighting from buses. Please use the same card to tap in and out.

If you lose your bank card, please call your Issuing Bank immediately to report loss and prevent misuse.

Please call your Issuing Bank for further assistance.

For NETS Bank Card users, you will have to transfer or deposit additional funds into your bank account to continue using SimplyGo.

You can pay for all public train and bus fares (basic and premium bus services) with a contactless NETS Bank Card.

Please note that for premium bus services, bank cards can be used to pay for fares only if they are operated by public transport operators (PTOs) and not private operators. All PTO-operated buses (basic and premium bus services) are installed with a standard card reader as shown below.

No. The fares charged using NETS Bank Card are the same as existing transit fares. Please refer to www.ptc.gov.sg/regulation/bus-rail/fare-structure for more information on fares.

Please note that concession fares do not apply with NETS Bank Card. Commuters eligible for concession schemes are entitled to be issued personalised smartcards that allow them to pay a subsidised fare.

There will be no additional charges when using Singapore-issued contactless bank cards for SimplyGo.

Transactions will be processed and deducted from your bank account. The aggregated charges will be accumulated for up to 5 days or after a total of $15 is spent on transit fares, whichever is earlier. The accumulated amount will be posted to your respective banks after 3 days. Postings will be reflected in your bank account after it has been processed by your Issuing Bank.

To view the breakdown of the aggregated fares, please login to your SimplyGo account on the TransitLink SimplyGo Portal or TL SimplyGo mobile app.

The finalised charges will also be posted in your account with the merchant descriptor name – “BUS/MRT”.

The aim of posting aggregated charges is to keep the account statement short and concise. The details of each transaction are available in your SimplyGo Account on the TransitLink SimplyGo Portal.

You will not be able to use your contactless bank card for transit if you have insufficient credit/funds in your card/bank account. You will encounter the following messages on the fare devices. As such, you will have to add additional funds into your bank account.

No, the reader will display “Bank Card SimplyGo” when you tap to alight or exit. The fare amount will be computed by the system after you have completed your journey.

You will be able to view the details of each trip in your SimplyGo account on the TransitLink SimplyGo Portal or TL SimplyGo mobile app. You can choose to turn on push notifications on your mobile devices to receive alerts on fare charges from the mobile app each time you tap out.

No. However, your card usage will be subject to funds available in your bank account.

If there are discrepancies in your travel transactions or billings, you can submit your claims for the travel transactions of the cards that are linked to your SimplyGo account via the “My Claims” page on the TransitLink SimplyGo Portal. Claims can only be filed for transactions that are up to 60 days after the date of incident.

For commuters who have not signed up for a SimplyGo Account or link their cards to their account, please do so at the TransitLink SimplyGo Portal. Please note that you can only view up to the last 180 days of your transactions history.

For MRT

A posting of “Incomplete Rail Transaction” will be reflected in your statement if the point of entry or exit is not recorded in the SimplyGo system. A flat fee of $2.00 will be charged, regardless of the distance travelled.

A posting of “Rail Overstay Charge” will be reflected in your statement if you exceed the time limit allowed for exiting a station. In this case, you will be charged an additional fee of $2.00, on top of the actual fares incurred.

For Buses

For missing entry, the ride will be charged from the first bus stop of bus route to the point of exit.

For missing exit, the ride will be charged from the point of entry to the end of bus route.

Currently, NETS Bank Card is unable to support Apple Pay or Google Pay.

NETSPay is not accepted for payment on board public transport.

POSB Smart Buddy wearable is not recommended for use in SimplyGo. All transit usage will be priced at full adult fare and users may experience intermittent performance.

You may visit the “My Statements” page in your SimplyGo Account on the TransitLink SimplyGo Portal to view the travel transactions and charges made on your card(s).

Transaction information includes journey information, trip information, trip fare and payment posting history. This information can be downloaded into PDF statements.

You can view up to the last 180 days of your transaction history.

NETS Contactless

NETS Contactless

All Questions

NETS contactless allows you to make a NETS payment simply by tapping your ATM/ Debit Card enabled with NETS contactless feature.

You will see the NETS contactless icon on your card.

You can tap to pay with NETS where you see the NETS contactless icon on a payment terminal, or on the NETS acceptance decal. More than 150,000 points in Singapore accept NETS contactless payments, including retail and F&B stores, self service kiosks, taxis and more.

NETS FlashPay

Filter by Category

All Questions

NETS FlashPay is a multi-purpose stored value card that you can use for traveling on buses, the MRT and LRT and shopping at retail stores.

You may top up your NETS FlashPay Card at any of the following locations:

- NETS App via Google Play Store or Apple App Store*

- NETS Customer Service Centre

- NETS Top Up Machines

- Top-Up Kiosks

- Assisted Service Kiosks

- SimplyGo Kiosks

- Local bank ATMs (DBS/POSB, OCBC and UOB)

- 7-Eleven stores*

- Buzz Pods*

- Cheers*

- FairPrice Xpress*

*A service fee may be chargeable.

You can store a maximum of S$500 in your NETS FlashPay Card.

Yes, NETS FlashPay Card has a validity period of up to 7 years. You may also check the expiry date of your NETS FlashPay card using the NETS App which can be downloaded via Google Play Store or Apple App Store.

You may check your card expiry date with NETS App.

- Download and launch NETS App

- Scroll down screen to NETS FlashPay, Motoring Card

- Select History and scan your NETS FlashPay Card by holding card against the back of your mobile (kindly ensure your mobile NFC is turned on)

Or you may check your card expiry at the Assisted Service Kiosks or Top-Up Kiosks at all MRT/LRT stations.

Yes. You are entitled to a refund of the remaining stored value in your NETS FlashPay Card within 2 years after your card expired.

However, there is a service charge of S$1 per month after the end of the first year expiry of your NETS FlashPay Card. Such levy will be deducted monthly from the stored value in your NETS FlashPay Card until the Stored Value is fully depleted, or until the refund has been made within the 2 years after the card expired, or until the 108th Calendar month (9 calendar years), whichever is earlier.

You may file a refund at the following channels:

SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres

- For card with less than $80 remaining balance, you can obtain an immediate cash refund at any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres.

- For card more than $80 remaining balance / registered Auto Top-up (ATU) / damaged cards, you may submit a manual refund form at SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres for the refund to be processed within 14 working days.

Local ATMs

- You may refund the remaining stored value at any local bank ATM. This amount will be credited directly to your bank account.

NETS Customer Service Centre

- Visit the NETS Customer Service Centre (351 Braddell Road #01-03 Singapore 579713) for refunds during operating hours 8:30am to 5:30pm (Mon– Fri except Public Holidays).

You may check your card balance and transaction history (up to the last 30 transactions) with NETS App.

Alternatively, you can check balance and/or print transaction history at any of the following:

- NETS Top-Up Machines (up to the last 25 transactions)

- Any DBS/POSB, OCBC or UOB ATM (up to the last 10 transactions)*

- NETS Customer Service Centre (up to the last 30 transactions)

- SimplyGo App (only public transport transaction history)

For more information on using NETS FlashPay Card, please visit https://www.nets.com.sg/nets/for-you/nets-flashpay.

If your NETS FlashPay Card is damaged/faulty, please visit the NETS Customer Service Centre located at 351 Braddell Road #01-03 Singapore 579713 – Operating Hours: 8:30 am to 5:30 pm (Mondays – Fridays) to have your card checked. If a refund is necessary, it will be processed and the remaining stored value will be credited into your designated bank account within 14 working days.

The NETS FlashPay Card is deemed non-retrievable once misplaced and there will be no refund for any lost or stolen NETS FlashPay Cards.

Please proceed to perform a statement printout at any DBS/POSB, OCBC or UOB ATMs (a nominal fee is applicable) or NETS self-service top-up terminals, or export PDF from NETS App.

Thereafter, send the printout/PDF together with the following details to info@nets.com.sg for investigation:

- Full name (as per NRIC)

- Contact No (Mobile No.)

- NETS FlashPay Card No.

- Transaction date

- Transaction amount

- Location

You will be notified on the findings and follow-up actions within 5 working days.

There could be several reasons leading to a declined transaction. The possible causes include (but are not limited to):

- Insufficient funds – You may check your card balance using NETS App. Alternatively, you may wish to register for the Auto Top-up service (refer to Auto Top-Up Service for more details)

- Card has expired – Please perform a refund of your remaining card balance. Refer to ‘Where can I get a refund for my NETS FlashPay Card?’ on refunds.

- Card has been blocked: If this is unexpected, please contact info@nets.com.sg for assistance.

- Your card has reached the spending limit of S$28,000 within a 12-month period.

Your NETS FlashPay Card will be blocked once the spending on each NETS Flashpay Card, within a 12-month period has reached the cumulative total of S$28,000. For enquiries or clarification, you may wish to contact NETS Customer Service Hotline at 6274 1212 or drop us an email on info@nets.com.sg.

You may use the NETS FlashPay Card to pay for your ERP, checkpoint toll and car park charges. Please note that the NETS FlashPay Card can only be used in the 2nd Generation In-Vehicle Units (2GIU) and the future On-Board Unit (OBU).

For ERP:

- Simply insert your NETS FlashPay Card into your vehicle’s 2GIU to pay for your ERP charges.

For Car Park:

- Where auto deduction is available, insert your FlashPay Card into your vehicle’s 2GIU to enter and exit the carpark.

- Where auto deduction is not available, tap and hold your NETS FlashPay Card on the car park reader.

To ensure a smooth payment experience with the NETS FlashPay Card at car parks, please take note of the following.

- For full Electronic Parking System (EPS) car parks, please keep your NETS FlashPay Card in the In-Vehicle Unit (IU) when entering and exiting the car park.

- For car parks that auto-detect the NETS FlashPay Card in the IU when entering the car park but not when exiting, kindly remove the NETS FlashPay Card from your IU and tap and hold the card on the car park reader when exiting.

- For car parks that do not auto-detect the NETS FlashPay Card in the IU when entering the car park, please tap and hold the card on the car park reader when entering and exiting the car park.

Yes, the NETS FlashPay Card can be used for vehicle tolls at the custom checkpoints.

The NETS FlashPay Card has a minimum top-up value of $5.

Yes, the deposit amount will be refunded to the registered credit/debit card after 21 working days. However, if your credit/debit card is terminated, you will need to inform NETS which local bank to receive back the deposit amount.

If the balance on your NETS FlashPay Card balance is less than $5, you will be alerted by a beeping tone when the card is inserted into the 2nd Generation In-Vehicle Unit (2GIU).

Yes, all Auto Top-Up users are required to place a $50 security deposit to continue the Auto Top-Up service.

The date reflected on your bank statement refers to the posting date for the Auto Top-Up transaction (usually a few days after the actual transaction date).

The delayed charging is part of the different settlement procedures with merchants, which can take up to 30 days.

You may contact the NETS Customer Service Hotline at 6274 1212 or email info@nets.com.sg to confirm your transactions.

You may contact the NETS Customer Service Hotline at 6274 1212 or email info@nets.com.sg to verify your transactions.

Please note that there is an interval of 3 calendar days between the Auto Top-Ups. If your Card received an Auto Top-Up of $30 on Monday, the next time an Auto Top-Up can be performed on your Card is on Friday of the same week.

If you require additional top ups during the 3-day interval, you may top up your NETS FlashPay Card manually at the following top up points:

- NETS Top-Up Machines

- NETS Self-Service Stations

- NETS App via Google Play Store or Apple App Store*

- NETS Customer Service Centre

- Top-Up Kiosks

- Assisted Service Kiosks

- SimplyGo Kiosks

- Local bank ATMs (DBS/POSB, OCBC and UOB)

- SMRT/SBST Passenger Service Centres

- 7-Eleven stores (except at Shell stations)*

- Buzz Pods*

- Cheers*

- FairPrice Xpress*

*A service fee may be charged by the service provider for each top-up.

You may de-register the Auto Top-Up at selected NETS Self Service Stations/Top Up Machines or NETS Customer Service Centre.

For NETS Self Service Stations or Top Up Machines with de-registration function available, please select “Auto Top Up” on the terminal menu, followed by “De-registration”.

There is no fee for the Auto Top-Up de-registration function.

Please wait for 14 working days for the de-registration process to be completed before proceeding to sign the same NETS FlashPay Card up for Auto Top-Up Facility.

Only locally-issued Mastercard from DBS/POSB, OCBC, UOB, HSBC, BOC, SCB and Maybank are eligible. For Visa, only locally issued DBS/POSB, UOB, HSBC and BOC cards are eligible.

Follow these simple steps to add a credit/debit card to your NETS App account:

- Log in to NETS App

- Click on “Profile” Icon on the top left of the home screen.

- Tap on “Payment Methods”.

- Tap on “Add NETS Bank Card” or “Add Amex/ Mastercard/ Visa”.

- Input your credit/debit card details and submit.

- You are all set!

Simply log in to your NETS App and ensure you have a valid credit/debit card saved, select your saved credit/debit card while performing top up for your NETS FlashPay Card.

Yes. You will first need to log in to your NETS App account, afterwards you may update the card expiry date and CVV by selecting your saved credit/debit card under “Payment Methods”.

For NETS Bank Card, you can only save 1 card. For other credit/debit cards, there is no limit to the number of cards you can save on the NETS App.

You will first need to log in to your NETS App account, afterwards you may select the credit/debit card you wish to remove in the “Payment Methods” page and proceed to “Remove card”.

Auto Top-Up service allows you to automatically top up your NETS FlashPay Card with your credit/debit card when there is insufficient stored value to make a payment transaction in Transit (MRT/Buses), ERP gantries and EPS (CEPAS-compliant) car park exits.

You may wish to apply for Auto Top-Up service to your NETS FlashPay Card with your locally-issued credit/debit card* as the source of funds through our NETS ATU Registration Page or using the NETS App which can be downloaded via Google Play Store or Apple App Store.

Upon successful registration, you will receive an activation code via SMS/email within 2 days.

Activate NETS FlashPay Auto Top-Up on your NFC-enabled mobile phone using the NETS App OR bring your activation code and NETS FlashPay Card to any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres to activate Auto Top-Up on your NETS FlashPay Card.

*Only locally-issued Mastercard from DBS/POSB, OCBC, UOB, HSBC, BOC, SCB and Maybank are eligible. For Visa, only locally issued DBS/POSB, UOB, HSBC and BOC cards are eligible.

You must be at least 18 years old in order to register for Auto Top-Up by credit/debit card.

Auto Top-Up service registration is free. However, a S$50 refundable deposit is required upon registering for the Auto Top-Up service.

For customers who registered using local-issued DBS/POSB and UOB Visa/MasterCard credit/debit card, the convenience fee will be waived. However, a convenience fee of S$0.25 (GST inclusive) is applicable on local-issued OCBC Visa/MasterCard credit/debit card and a convenience fee of $0.50 (GST inclusive) on any other applicable Banks’ card for every successful Auto Top-Up transaction.

With the Auto Top-Up arrangement, NETS will top up the registered NETS FlashPay Card / NETS Motoring Card whenever the card stored value is insufficient to pay for ERP or car park charges. NETS will then charge/ collect the top-up amount from the registered credit/ debit card. In the event that NETS is unable to charge/ collect the top-up amount from the credit/ debit card, NETS will offset the outstanding amount from your deposit.

You can register up to five (5) NETS FlashPay Cards with a single credit/debit card for Auto Top-Up.

This is a notification sent during Auto Top-Up service registration to authenticate the validity of your credit/debit card. There is no monetary deduction made to your credit/debit card.

After you have registered for Auto Top-Up service, you should receive an activation code on the mobile number that you have provided at the point of registration on the following day. You can activate the Auto Top-Up service with the activation code via NETS App or NETS ATU Registration Portal.

Alternatively, you can activate your Auto Top-Up at any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres. Please bring along your NETS FlashPay Card registered for Auto Top-Up and the activation code required for the activation.

The activation code will be sent to the mobile number that you have provided at the point of registration at NETS ATU Registration Portal / NETS App via Google Play Store or Apple App Store. If you have not received your activation code after 2 days, please request for a new activation code by calling the NETS Customer Service Hotline at 6274 1212. A new activation code will be sent on the following day.

Your activation code is valid for 7 days from the date of issuance. The expiry date of the activation code will be stated in the email notification to you.

You may request a new activation code by calling our NETS Customer Service Hotline at 6274 1212. A new activation code will be sent on the following day within 30 days of Auto-Top service registration. If your registration for Auto Top-Up service has passed 30 days, please proceed to re-register for the Auto Top-Up service.

The S$50 deposit that was collected during registration will be refunded to you and credited back to the registered credit/ debit card within 14 working days upon the expiry of the Auto Top-Up registration which has a 30-day validity period. The refunded amount will be reflected in your next credit/ debit card statement.

You may choose top-up value of S$30, S$40 or S$50.

Yes. You are able to do so. However, you will need to de-register the existing Auto Top-Up service on your NETS FlashPay Card at any NETS Top-Up Machine or NETS Customer Service Centre.

Once you have de-registered, you can proceed to register for the Auto Top-Up service with your preferred selected top-up amount after 14 working days from the date of de-registration on our NETS ATU Registration Portal or via the NETS App from Google Play Store or Apple App Store.

The Auto Top-Up transaction will be reflected as “FlashPay Auto Top Up”.

Your Auto Top-Up enabled NETS FlashPay Card may have been blocked due to an outstanding Auto Top-Up amount on this card. You will need to make payment for the outstanding amount at NETS Customer Service Centre. Upon successful payment, your card will be unblocked for usage.

For co-brand credit/debit card with Auto Top-Up Facility, please note that the credit/debit card may still be used even though the FlashPay function is blocked.

You will need to de-register the Auto Top-Up service on your NETS FlashPay Card at selected NETS Top-Up Machine or NETS Customer Service Centre.

For NETS Top-Up Machines with de-registration function available, please select “Auto Top Up” on the terminal menu, followed by “De-registration”.

If you do not intend to continue to use the NETS FlashPay Card, you may perform an online refund of the remaining stored value in the Card, 14 working days after de-registration at any local bank ATM.

Yes. You may cancel the service. For cancellation, you will need to de-register the Auto Top-Up at selected NETS Top-Up Machines or NETS Customer Service Centre.

For NETS Top-Up Machines with de-registration function available, please select “Auto Top Up” on the terminal menu, followed by “De-registration”.

1. You may de-register the Auto Top-Up service at any NETS Top Up Machines. Upon deregistration, you may perform a refund of the remaining stored value in the card at any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres, local bank ATM or NETS Customer Service Centre.

SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres

- For card with less than $100 remaining balance, you can obtain an immediate cash refund at any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres.

- For card more than $100 remaining balance / registered Auto Top-up (ATU) / damaged cards, you may submit a manual refund form at SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres for the refund to be processed within 14 working days.

Local ATMs

- This amount will be credited directly to your bank account.

NETS Customer Service Centre

- Visit the NETS Customer Service Centre (351 Braddell Road #01-03 Singapore 579713) for refunds during operating hours 8:30am to 5:30pm (Mon– Fri except Public Holidays).

2. Alternatively, you may complete a manual refund form at any SimplyGo Ticket Offices and SimplyGo Ticketing Service Centres. Your Auto Top-up service will automatically be de-registered once you surrender your NETS FlashPay Card. Your card balance, together with the security deposit amount will be refunded to your bank account of choice, according to information provided by you in the refund form within 14 working days.

Please note that your card will be cut up and retained when you submit it for deferred refund. You’ll need to notify your bank should you require any replacement card or to cancel your account before submitting the card for refund.

Please notify your Bank immediately to cancel your credit/debit card.

Once you have notified your Bank, please contact our NETS Customer Service Hotline at 6274 1212 to report the loss of your Auto Top-Up enabled NETS FlashPay Card. Upon receipt of a loss report, NETS shall cancel the Auto Top-Up within 48 hours. However, you may still be liable for any payment transactions on the card during the 48-hour period.

Upon receiving your new replacement credit/debit card from your Bank, you may update your credit/debit card details through our NETS ATU Registration Page or using the NETS App which can be downloaded via Google Play Store or Apple App Store.

NETS App is an Android and iOS application that allows you to perform the following NETS Flashpay Card transaction using your mobile device:

- FlashPay Top Up*

- FlashPay Auto Top-Up (ATU) registration

- FlashPay Auto Top-Up Activation

- Balance Enquiry

- Card Expiry Enquiry

- Transaction History

*Top-up fee applicable

The NETS App can be found on the Google Play Store or Apple App Store.

After installation, you can launch the NETS App in 2 ways:

- For iOS users, you can locate the NETS App icon in your mobile device and launch it.

- For Android users, you can locate the NETS App icon in your mobile device and launch it. If NFC is not enabled, a prompt will appear to enable NFC. Select ‘Yes’ and your phone settings menu will launch for you to enable NFC. Alternatively, if your phone is NFC enabled, place the card against the back of your phone where the NFC antenna is located, the NETS App will launch automatically once it reads the NETS FlashPay Card.

1. iOS Users

You may wish to try placing your NETS FlashPay Card (vertically) behind the top edge of your iPhone to find a better connection with your iPhone’s NFC antenna.

2. Android Users

You may wish to try placing your NETS FlashPay Card behind the centre of your Android phone to find a better connection with your phone’s NFC antenna. Otherwise, try placing behind the top or bottom of your phone as different phone models may have their NFC antenna set-up differently.

1. FlashPay Top Up

- Upon launching the NETS App, select ‘Top-Up’ under NETS FlashPay, Motoring Card.

- You will be prompted to hold your NETS FlashPay Card against the back of your mobile device to begin

- Next, select the preferred amount for top-up

- Proceed to key in your preferred credit/ debit card, or select your saved credit/debit card for the top-up transaction

- Enter the OTP to authorize the payment

- You will be prompted to hold your NETS FlashPay Card against the back of your mobile device to complete the Top-Up.

2. FlashPay Auto Top-Up registration

Please have your NETS FlashPay Card with you and follow the steps below to register ATU via the NETS App:

- Upon launching the NETS App, select ‘Auto Top-Up’ under NETS FlashPay, Motoring Card

- Select “Auto Top-Up Registration”

- Complete the form with your preferred credit/debit card details and NETS FlashPay Card CAN number

- Proceed to ‘Submit’

3. FlashPay Auto Top-Up Activation

Please follow the steps below to activate ATU via the NETS App:

- Upon launching the NETS App, select ‘Auto Top-Up’ under NETS FlashPay, Motoring Card

- Select “Auto Top-Up Activation”

- Enter the 6-digit ATU activation code sent to you via SMS or email

- Proceed to “Activate”

- ‘ATU Activation Successful’ message will be displayed once ATU activation is completed.

4. FlashPay Card Enquiry

You may do the following enquires using NETS App.

- Balance Enquiry

- Card Expiry Enquiry

- Transaction History

Please follow the steps below to make the enquiries:

- Upon launching the NETS App, select more ‘…’ under NETS FlashPay, Motoring Card

- Select “Card Profile”

- You will be prompted to hold your NETS FlashPay Card against the back of your mobile device to begin

- You will be able to read your NETS FlashPay CAN number and expiry date.

- Select back ‘<’ at the top left hand corner and you will be able to read your balance and see recent transaction history.

- Select ‘History’ if you wish to see past transactions.

Android mobile devices will be required to run Android 5.0 or later. iOS mobile devices will be required to run iOS 9 to download NETS App. In order to read the NETS Flashpay Card via the Near Field Communication (NFC), iOS mobile devices model must be iPhone 7 or latest and running on iOS 13 or later.

We recommend the removal of the mobile device rear case cover (which may cause interference) before reading the FlashPay Card.

Rooted mobile devices will not be able to perform transactions on the NETS App due to security concerns.

You can re-launch NETS App and place your NETS FlashPay Card firmly against the back of your mobile device. If there are any funds that were not successfully topped up previously, NETS App will automatically proceed to top up the card.

If the payment page does not direct you back to the success message on the homepage, you can re-launch the NETS App to enquire your NETS FlashPay Card to see if any funds have been loaded onto your card. If there is no top-up, there should not be any deductions made from your credit/debit card account. Alternatively, you may wish to contact the issuing bank of your credit/debit card to confirm.

For customers who top-up using Singapore-issued DBS/POSB, OCBC and UOB Visa/MasterCard credit/debit card, the convenience fee will be waived. However, a convenience fee* of $0.50 (GST inclusive) is applicable on any other applicable Banks’ card for every successful Top-Up transaction.

*In the event of a top-up dispute, the convenience fee charged for the top-up transaction will remain non-refundable. The fee is charged due to the transaction cost imposed by the banks and the card schemes.

Currently, the top-up service accepts all Mastercard, Visa and AMEX cards issued in Singapore and Malaysia. For logged in NETS App users, NETS Bank Cards can be used for the top-up service as well.

You can perform up to three (3) top-up transactions on the same day. And up to twelve (12) top-up transactions in a week for your NETS FlashPay card.

For credit card security reasons, the same credit or debit card can only be used up to ten (10) top-up transactions and no more than thirty-five (35) top-up transactions a week.

You may try to re-launch your NETS App and place your card firmly against the back of your mobile device to update your card. Alternatively, you may attempt to perform the top-up on another device.

Should the value of your card was not updated and your credit/debit card was deducted, you may contact NETS Customer Service Hotline at 6274 1212 or email info@nets.com.sg to verify your transaction(s).

You are required to provide your NETS FlashPay Card CAN (16-digit number printed on the back of your card), the first four and last four digits of your credit/debit card (for e.g. 5569-xxxx-xxxx-1234), the top-up amount, the approximate transaction date, transaction time and your contact details such as email and contact number for transactions verifications.

RSVP (Retailer Stored Value Programme) allows consumers to enjoy exclusive deals offered by participating merchants.

RSVP cards can be in the form of:

- Merchant co-branded card: These can only be used at participant merchants.

- Generic NETS FlashPay Card: These cards come enabled with RSVP wallets, which can be topped up for use at participating merchants (coming soon).

RSVP deals can be offered in the form of:

- Dollar Promotions: Pay with RSVP and get a discount on merchandise.

- Item Promotions: Purchase sets of items for a discounted price (e.g. 10 cups of coffee for the price of 8, only redeemable for coffee).

Please check the back of your NETS FlashPay Card for the RSVP logo.

Your NETS FlashPay Card can store RSVP Dollar/Item(s) from as many as 20 different merchants. However, some Co-brand FlashPay Cards may be restricted for use by a single merchant for RSVP Issuance.

From a single merchant, you can enjoy a maximum of:

- 6 different RSVP Items and

- 1 RSVP Dollar promotion

You may check your RSVP balance at the respective merchant outlet for the merchant’s RSVP balance.

No, there are 2 different stored value wallets found on your NETS FlashPay Card.

The NETS FlashPay Card balance is a public wallet that can used to pay for your transport, ERP, EPS and retail purchases.

The RSVP balance is a private wallet that can only be used for your purchases from a specific retail merchant.

Payment for your RSVP Dollar/Item(s) can be made at the respective merchants via NETS FlashPay Card, NETS, cash or credit/debit card (subject to merchant acceptance).

Please note that RSVP top-up is not available for NETS FlashPay Cards with less than 3 months to expiry.

You may continue to use your remaining RSVP Dollar/Item(s) on your NETS FlashPay Card. However, you will not be able to top up additional RSVP Dollar/Item(s) after it has expired/been blocked or refunded.

Unfortunately, we are not able to transfer the remaining RSVP Dollar/Item(s) to your new card. However, NETS will process the refund of your remaining RSVP Dollar/Item(s) via a printed letter/voucher for your redemption at the specified merchant within 14 working days.

To obtain a refund, please submit your NETS FlashPay Card with remaining balance of active RSVP Dollar/Item program(s) for refund at the NETS Customer Service Centre or any TransitLink office.

There is no refund and replacement for a lost or stolen NETS FlashPay Card. The accompanying RSVP Dollar/Item(s) will not be replaced as well.

Yes, you can continue to enjoy the remaining RSVP Dollar/Item(s) on your NETS FlashPay Card as long as it is active.

Unfortunately, there is no refund for expired RSVP Dollar/Item(s).

Please submit your NETS FlashPay Card with remaining balance of active RSVP Dollar/Item program(s) for refund at the NETS Customer Service Centre or any TransitLink office. NETS will process the refund of your remaining RSVP Dollar/Item(s) via a printed letter/voucher for your redemption at the specified merchant within 14 working days.

Please refer to the Terms and Conditions below:

If you have any enquiries or wish to apply for a refund of the RSVP value in a merchant co-branded card, please contact the respective merchant for assistance.

Did not find what you were looking for? You can still reach us at the following:

Digital Live Agent

(Please click the Digital Assistant icon located

at the bottom right corner of the page)

Daily: 9am to 9pm

NETS Main Office

351 Braddell Road #01-03

Singapore 579713

8:30am to 5:30pm (Mondays – Fridays)

We are closed on Saturdays, Sundays and Public Holidays.

NETS In-App Payment

NETS In-App Payment

Filter by Category

All Questions

NETS in-app payment is a new payment mode that allows consumers to securely add their NETS Bank Card in merchant apps and use it to conveniently pay for purchases with just one click.

You can use NETS in-app payment on merchant mobile apps that display NETS as a payment method option. NETS in-app payment is currently available on the following apps, with more to be added soon!

- CDG Zig

- Singtel Prepaid hi!App

- AXS Payment

- KcutsGO

- Sushi Tei

- Bee Cheng Hiang

- Luckin Coffee

- Nestia

- Kenangan Coffee

View the full list of supported merchant apps here.

You can start using NETS in-app payment by selecting NETS as a new payment method in supported mobile apps.

You will be prompted to provide some details to verify your identity via an SMS-OTP sent to your mobile number, by your card-issuing bank.

For DBS, POSB and OCBC

You may add either your ATM, debit cards or NETS-enabled credit cards to the merchant mobile apps.

For UOB

Only ATM or debit cards can be added to merchant mobile apps.

During the check-out or payment page of a supported mobile app, select NETS as your preferred payment method and confirm the payment to pay for your purchases. No other action will be required.

NETS in-app payment uses tokenisation to protect and secure your card details from being exposed and misused by any unauthorised third parties. Each token created is also unique to the specific merchant and your mobile device, to minimise any unauthorised fraudulent transactions.

There is no additional fee when you use NETS in-app payment.

There is no need to setup any login credentials in order to start using NETS in-app payment on supported mobile apps.

You may contact the merchant directly to request for a refund, as merchants have their own refund policy.

Your NETS Bank Card details will be secured as they are not stored within the merchant’s mobile app nor your mobile device. However, you are advised to contact your card issuing bank immediately to block or temporarily suspend your card.

You should contact your card issuing bank immediately to report your concerns.

To use NETS in-app payment, you will need to grant the merchant app with the permissions that will allow NETS to identify your mobile device’s ID for security purposes. NETS and the merchants will never access your photos, media, files, nor make any calls on behalf of you.

Using NETS in-app payment, you can pay for transactions up to below limits:

- DBS/POSB & UOB NETS Bank Cards: Transaction amount will be up to the card’s available daily limit.

- OCBC NETS Bank Cards: Transaction amount will be capped at the lower of the card’s available daily limit or $1,000.

Note that merchant may choose to implement a lower transaction limit on the merchant mobile app. Kindly check with the merchant directly to confirm on the transaction limit.

You can add only one bank card to use NETS in-app payment. If you would like to change the NETS card that you’ve added to in-app payment, you may remove the card that was previously added and register the new card.

Please follow the instructions within the supported mobile app to remove your NETS card from in-app payment.

To protect your card details from being exposed to other unauthorised parties, each in-app payment-generated token may expire when you log out of the merchant’s mobile app. Please add your preferred NETS Bank Card again to continue using in-app payment.

Set NETS as the default payment method once you have added your NETS Bank Card to the CDG Zig app in the Manage Payment section.

Alternatively, you can also select NETS as the payment mode at the point of booking your trip.

Once you have done so, just book a ride as usual and NETS in-app payment will be used to complete the ride payment.

Yes. When you have boarded the hailed taxi, you may select NETS as the payment mode before pairing your CDG Zig app to the taxi (either via scanning the taxi QR code or manually keying in the license plate number).

There is no need to do so. ComfortDelGro drivers are all effectively trained to identify NETS in-app payment as a payment mode when the trip starts via their display terminals, along with other trip-related information.

You will be able to use NETS in-app payment to conveniently top-up your Singtel Prepaid balance via the Singtel Prepaid hi!App.

After logging into the Singtel Prepaid hi!App, select ‘Top-Up Cards’ and select your desired top-up amount. You will then be able to select NETS as your preferred payment method.

For first time NETS in-app payment users, you will first need to add a NETS enabled card, and this card will be used for your subsequent top-ups via NETS on Singtel Prepaid hi!App.

NETS Motoring Card

NETS Motoring Card

All Questions

It is a contactless, multi-purpose stored value CEPAS card that can be used for ERP and car park payments in Singapore. The NETS Motoring Card can only be used in 2nd Generation In-Vehicle Units (2GIU) and the future On-Board Unit (OBU).

The NETS Motoring Card will replace the current CashCard. Please note that the NETS Motoring Card can only be used in the 2nd Generation In-Vehicle Units (2GIU) and the future On-Board Unit (OBU). If you have a first generation IU, you can only use the CashCard.

The NETS Motoring Card also offers the following features:

- Auto Top-Up

- Enable auto top-up with your credit/debit card as your source of funds and never worry about insufficient card value again

- Contactless Functionality

- For car park readers that do not support automatic fee deduction, you can now simply tap and hold your NETS Motoring Card on the carpark reader instead of having to insert your card

- NETS FlashPay Reader App or NETS App (coming soon)

- The NETS Motoring Card comes with a supporting mobile app which allows you to check your card balance and expiry, view your transaction history, perform top-ups and apply for Auto Top-Up.

- Exclusive privileges and benefits (terms and conditions apply):

- WINK+ points with ERP payments

- Free card insurance by HL Assurance

The NETS Motoring Card is available at $10 per card ($5 card cost + $5 stored value) and can be purchased from all petrol stations and convenience stores.

Our distributors have their own processes to distribute the cards across all their stores. Some stores may run out of cards faster than others. You may try to go to another store or drop by the NETS Customer Service Centre. We will always have a card for you.

NETS Customer Service Centre

351 Braddell Road #01-03 Singapore 579713

Operating Hours: 8.30am – 5.30pm (Mondays to Fridays)

You may use the NETS FlashPay Card to pay for your ERP, checkpoint toll and car park charges. Please note that the NETS FlashPay Card can only be used in the 2nd Generation In-Vehicle Units (2GIU) and the future On-Board Unit (OBU).

For ERP:

- Simply insert your NETS FlashPay Card into your vehicle’s 2GIU to pay for your ERP charges.

For Car Park:

- Where auto deduction is available, insert your NETS Motoring Card into your vehicle’s 2GIU to enter and exit the carpark.

- Where auto deduction is not available, tap and hold your NETS Motoring Card on the car park reader.

You can store a maximum of S$500 in your NETS Motoring Card.

To ensure a smooth payment experience with the NETS Motoring Card at car parks, please take note of the following.

- For full Electronic Parking System (EPS) car parks, please keep your NETS Motoring Card in the In-Vehicle Unit (IU) when entering and exiting the car park.

- For car parks that auto-detect the NETS Motoring Card in the IU when entering the car park but not when exiting, kindly remove the NETS Motoring Card from your IU and tap and hold the card on the car park reader when exiting.

- For car parks that do not auto-detect the NETS Motoring Card in the IU when entering the car park, please tap and hold the card on the car park reader when entering and exiting the car park.

Yes. You can check the transaction history (up to the last 30 transactions) of your NETS Motoring Card using the NETS App which can be downloaded via Google Play Store or Apple App Store.

Alternatively, you can check and/or print at any of the following:

- NETS Customer Service Centre (up to the last 30 transactions)

- NETS Top-Up Machines (up to the last 25 transactions)

- Any DBS/POSB, OCBC or UOB ATM (up to the last 10 transactions)*

- NETS Self-Service Top-Up Stations

*Please note that a fee of $0.20 (GST inclusive) is chargeable for each statement print.

Yes, the NETS Motoring Card can be used for vehicle tolls at the customs checkpoint.

You may top up your NETS Motoring Card at any of the following locations:

- NETS App via Google Play Store or Apple App Store*

- NETS Customer Service Centre

- NETS Top Up Machines

- Add Value Machine Plus (AVM+)

- General Ticketing Machines (GTM)

- Local bank ATMs (DBS/POSB, OCBC and UOB)

- 7-Eleven stores*

- Buzz Pods*

- Cheers*

- FairPrice Xpress*

- TransitLink Ticket Office*

*A service fee may be chargeable.

The NETS Motoring Card has a minimum top-up value of $10.

Yes. You are entitled to a refund of the remaining stored value in your NETS Motoring Card within 2 years after your card expired.

However, there is a service charge of S$1 per month after the end of the first year expiry of your NETS Motoring Card. Such levy will be deducted monthly from the stored value in your NETS Motoring Card until the Stored Value is fully depleted, or until the refund has been made within the 2 years after the card expired, or until the 108th Calendar month (9 calendar years), whichever is earlier.

You may file a refund at the following channels:

Local ATMs

- You may refund the remaining stored value at any local bank ATM. This amount will be credited directly to your bank account.

NETS Customer Service Centre

- Visit the NETS Customer Service Centre (351 Braddell Road #01-03 Singapore 579713) for refunds during operating hours 8:30am to 5:30pm (Mon– Fri except Public Holidays).

If your NETS Motoring Card is damaged/faulty, please visit the NETS Customer Service Centre located at 351 Braddell Road #01-03 Singapore 579713 – Operating Hours: 8:30 am to 5:30 pm (Mondays – Fridays) to have your card checked. If a refund is necessary, it will be processed and the remaining stored value will be credited into your designated bank account within 14 working days.

The NETS Motoring Card is deemed non-retrievable once misplaced. There is no refund for lost and/or stolen NETS Motoring Cards.

For cards registered under FlashPay Shield, insurance coverage may apply. Click here for the full FAQ and T&Cs.

Please proceed to perform a statement printout at any DBS/POSB, OCBC or UOB ATMs (a nominal fee is applicable) or NETS self-service top-up terminals, or export PDF from NETS App.

Thereafter, send the printout/PDF together with the following details to info@nets.com.sg for investigation:

- Full name (as per NRIC)

- Contact No (Mobile No.)

- NETS Motoring Card No.

- Transaction date

- Transaction Amount

- Location

You will be notified on the findings and follow-up actions within 5 working days.

If the balance on your NETS Motoring Card balance is less than $5, you will be alerted by a beeping tone when the card is inserted into the 2nd Generation In-Vehicle Unit (2GIU).

You may refer to the terms and conditions here.

There could be several reasons leading to a declined transaction. The possible causes include (but are not limited to):

- Insufficient funds – You may check your card balance using NETS App. Alternatively, you may wish to register for the Auto Top-up service (refer to Auto Top-Up Service for more details)

- Card has expired – Please perform a refund of your remaining card balance. Refer to ‘Where can I get a refund for my NETS Motoring Card?’ on refunds.

- Card has been blocked: If this is unexpected, please contact info@nets.com.sg for assistance.

- Your card has reached the spending limit of S$28,000 within a 12-month period.

Your NETS Motoring Card will be blocked once the spending on each NETS Motoring Card, within a 12-month period has reached the cumulative total of S$28,000. For enquiries or clarification, you may wish to contact NETS Customer Service Hotline at 6274 1212 or drop us an email on info@nets.com.sg.

Yes, your NETS Motoring Card has a validity period of up to 7 years. You may check the expiry date printed at the back of your NETS Motoring Card.

Follow these simple steps to add a credit/debit card to your NETS App account:

- Log in to NETS App

- Click on “Profile” Icon on the top left of the home screen.

- Tap on “Payment Methods”.

- Tap on “Add NETS Bank Card” or “Add Amex/ Mastercard/ Visa”.

- Input your credit/debit card details and submit.

- You are all set!

Simply log in to your NETS App and ensure you have a valid credit/debit card saved, select your saved credit/debit card while performing top up for your NETS Motoring Card.

Yes. You will first need to log in to your NETS App account, afterwards you may update the card expiry date and CVV by selecting your saved credit/debit card under “Payment Methods”.

For NETS Bank Card, you can only save 1 card. For other credit/debit cards, there is no limit to the number of cards you can save on the NETS App.

You will first need to log in to your NETS App account, afterwards you may select the credit/debit card you wish to remove in the “Payment Methods” page and proceed to “Remove card”.

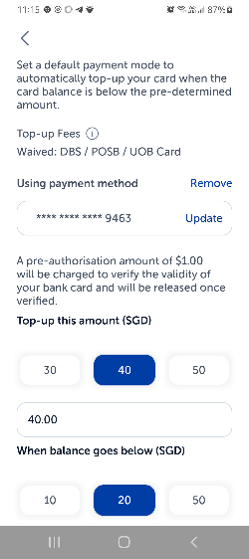

Auto Top-up service allows you to automatically top up your NETS Motoring Card with your credit/debit card when there is insufficient stored value to make a payment transaction at ERP gantries and EPS (CEPAS-compliant) car park exits.

You may wish to apply for Auto Top-up service to your NETS Motoring Card with your locally-issued credit/debit card* as the source of funds through our NETS ATU Registration Page or using the NETS App which can be downloaded via Google Play Store or Apple App Store.

Upon successful registration, you will receive an activation code via SMS/email within 2 days.

Activate NETS Motoring Auto Top-up on your NFC-enabled mobile phone using the NETS App OR bring your activation code and NETS Motoring Card to any TransitLink Ticket Office to activate Auto Top-up on your NETS Motoring Card.