Real-Time Gross Settlement Solution

Conduct large-value interbank funds transfers reliably in real-time. With NETS Real-Time Gross Settlement (RTGS), transfers are final and irrevocably settled. With our solution, Central Banks can manage interbank high-value payments settlement risks and implement regulatory and monetary controls in the financial market.

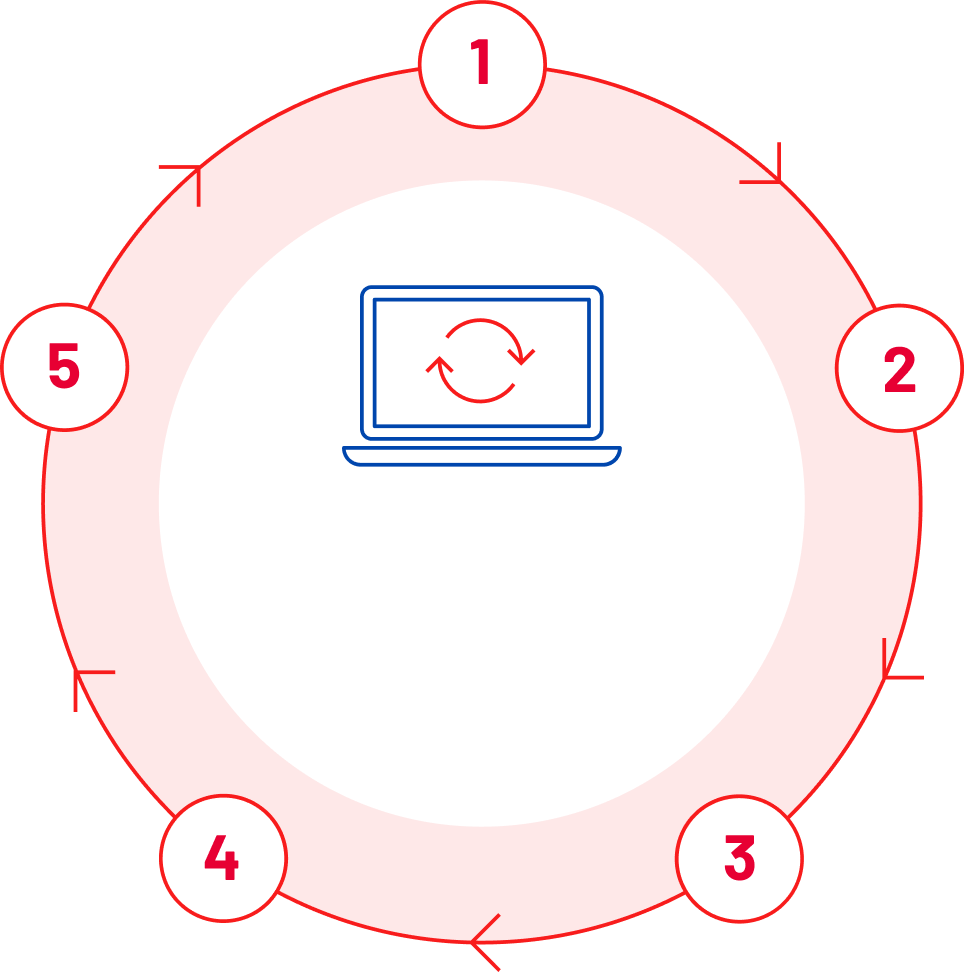

How does NETS Real-Time Gross Settlement work?

Modular and user-friendly interface

NETS RTGS is a complete solution that is user-friendly and intuitive. Its rich functionalities provide the flexibility needed to support diverse business requirements and processes. Users have agency to manage administrative functions, set alerts, manage payments, optimise liquidity and generate reports.

NETS Real-Time

Gross Settlement

Real-time dashboard for data management and liquidity monitoring

Facilitate timely decisions with NETS RTGS. The solution is designed with an emphasis on data management via application programming interface (APIs) to provide real-time data to users. Users have access to a real-time dashboard with an overview of market liquidity and individual participant information.

Secure and open architecture

NETS RTGS is designed with the highest security standards and is configured to operate 24/7 with zero downtime. With deployment capabilities across multiple sites for enhanced resiliency, its modular architecture is scalable to support evolving business and market needs globally.

Interoperable

NETS RTGS supports interoperability between domestic and cross-border payment systems, enabling improved end-to-end payment delivery times and reduced operational costs. It is equipped with the capability to facilitate regional and global interoperability between different payment systems.

Global industry standards

NETS RTGS is compliant with the BIS and IOSCO Principles for Financial Market Infrastructures and compatible with SWIFT.

Global industry standards

NETS RTGS is compliant with the BIS and IOSCO Principles for Financial Market Infrastructures and compatible with SWIFT.

Real-time dashboard for data management and liquidity monitoring

Facilitate timely decisions with NETS RTGS. The solution is designed with an emphasis on data management via application programming interface (APIs) to provide real-time data to users. Users have access to a real-time dashboard with an overview of market liquidity and individual participant information.

Interoperable

NETS RTGS supports interoperability between domestic and cross-border payment systems, enabling improved end-to-end payment delivery times and reduced operational costs. It is equipped with the capability to facilitate regional and global interoperability between different payment systems.

Secure and open architecture

NETS RTGS is designed with the highest security standards and is configured to operate 24/7 with zero downtime. With deployment capabilities across multiple sites for enhanced resiliency, its modular architecture is scalable to support evolving business and market needs globally.

Key Features of NETS Real-Time Gross Settlement

Settlement

Account Management

Liquidity Management

Message Transformation and Processing

Benefits of NETS Real-Time Gross Settlement

Provides an overview of payments in queue with queue re-prioritisation, hold and cancellation features.

Offers standard operational and customisable reports, together with rich enquiry list for both Central Bank and Participant to extract data and perform analytics.

Supports payment and securities settlement messages through multiple alternative channels in the event of a contingency, plus manual workflow for transfer of payment files and interface files to external systems.

Automated billing and flexible billing parameters for billing rates and cycles.

Need tailored, expert advice?