NETS Bank Card

NETS it. Tap it!

Tap for faster payments with contactless NETS Bank Cards

Zip through cashiers faster with our contactless-enabled next generation NETS Bank Cards. No more fumbling for cash or keying in card PIN to complete payment as our contactless NETS Bank Cards let you tap your way to quicker, more efficient payments.

Benefits

Why contactless NETS Bank Card?

Faster, seamless payments

Tap for faster payments with your contactless NETS Bank Card.

Pay securely

Contactless technology prevents the misuse of your banking and personal data.

Greater convenience

No PIN needed for transactions under $100.

SUPPORTED NETS bank CARDS

Tap to pay with contactless NETS Bank Card

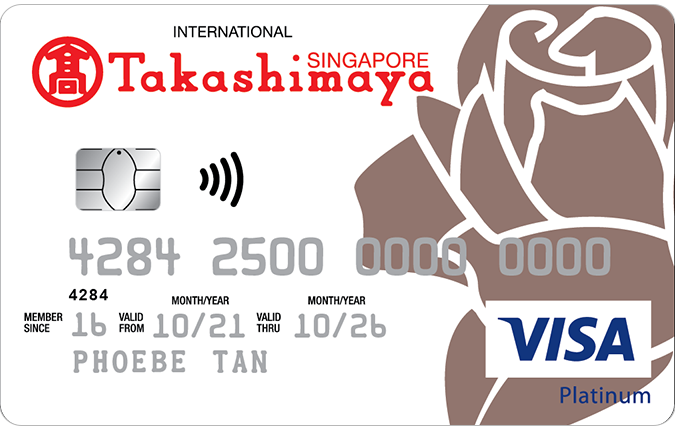

Here are some examples of debit cards and ATM cards with NETS contactless payment. No PIN is required for transactions below $100. These cards can be added to the NETS App.

Visa Debit Card *NEW*

Mastercard Debit Card

Note: For added security, Maybank Platinum Debit Cards will require a PIN for all NETS purchases.

ATM Card with NETS contactless feature

Look out for the NETS contactless icon on your ATM card.

Pro tip: Always inform cashiers early that you will be paying by NETS to speed up the payment transaction. For self-checkout, please select “NETS” as the mode of payment before tapping on the payment terminal to complete the transaction.

Simplygo

Use contactless NETS Bank Cards for MRT and bus rides

Travel with ease using your ATM cards with NETS contactless feature for MRT and bus rides.

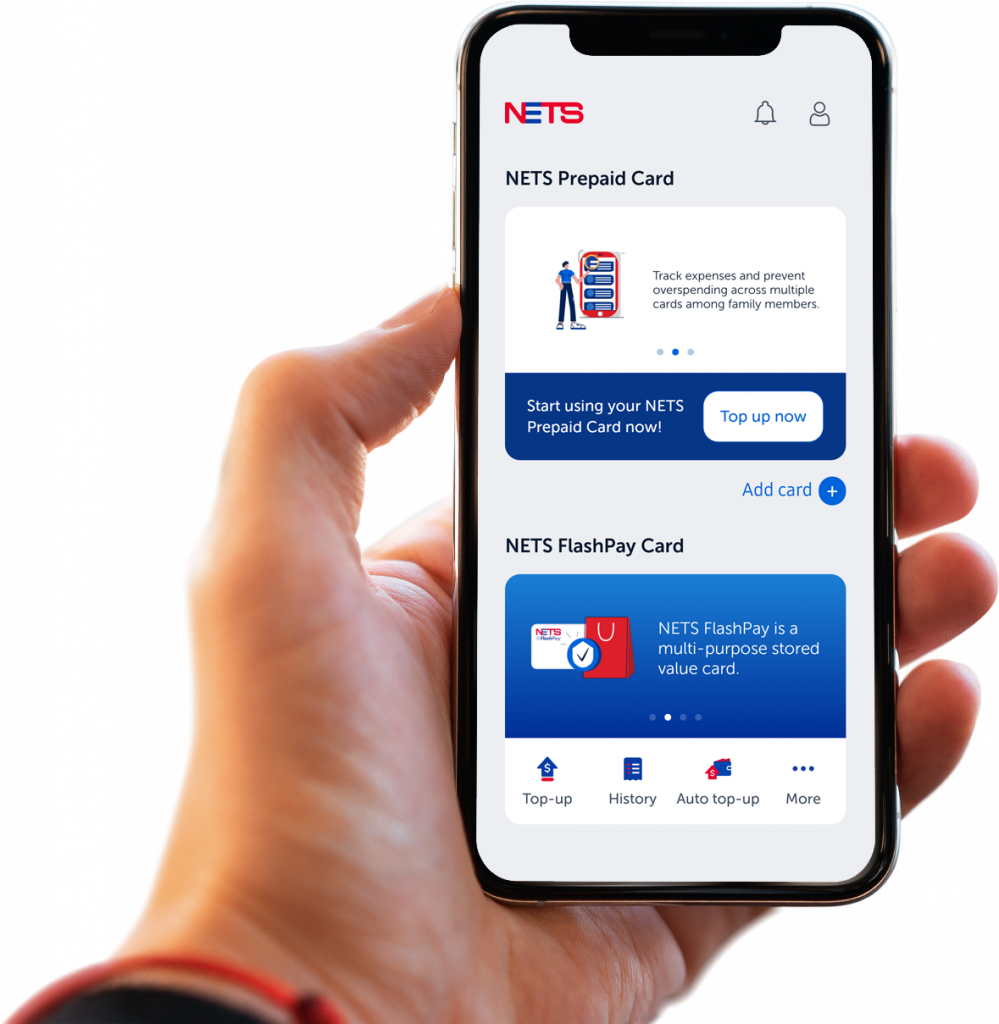

Pay in-app with NETS

NETS’ new in-app payment method allows you to digitise your NETS Bank Card in selected merchants’ mobile apps, offering you convenience and peace of mind at your fingertips.

Highlights

Frequently Asked Questions

Filter by Category

All Questions

Did not find what you were looking for? You can still reach us at the following: