Travel with NETS

Making payment when travelling overseas just got easier with NETS

Benefits

Why travel with NETS?

Better savings

Enjoy competitive foreign exchange rates and zero currency conversion fees.

Increased security

Travel with a peace of mind without needing large amounts of cash and foreign currency on hand.

Greater convenience

Shop and dine with ease without running out of cash.

how to use

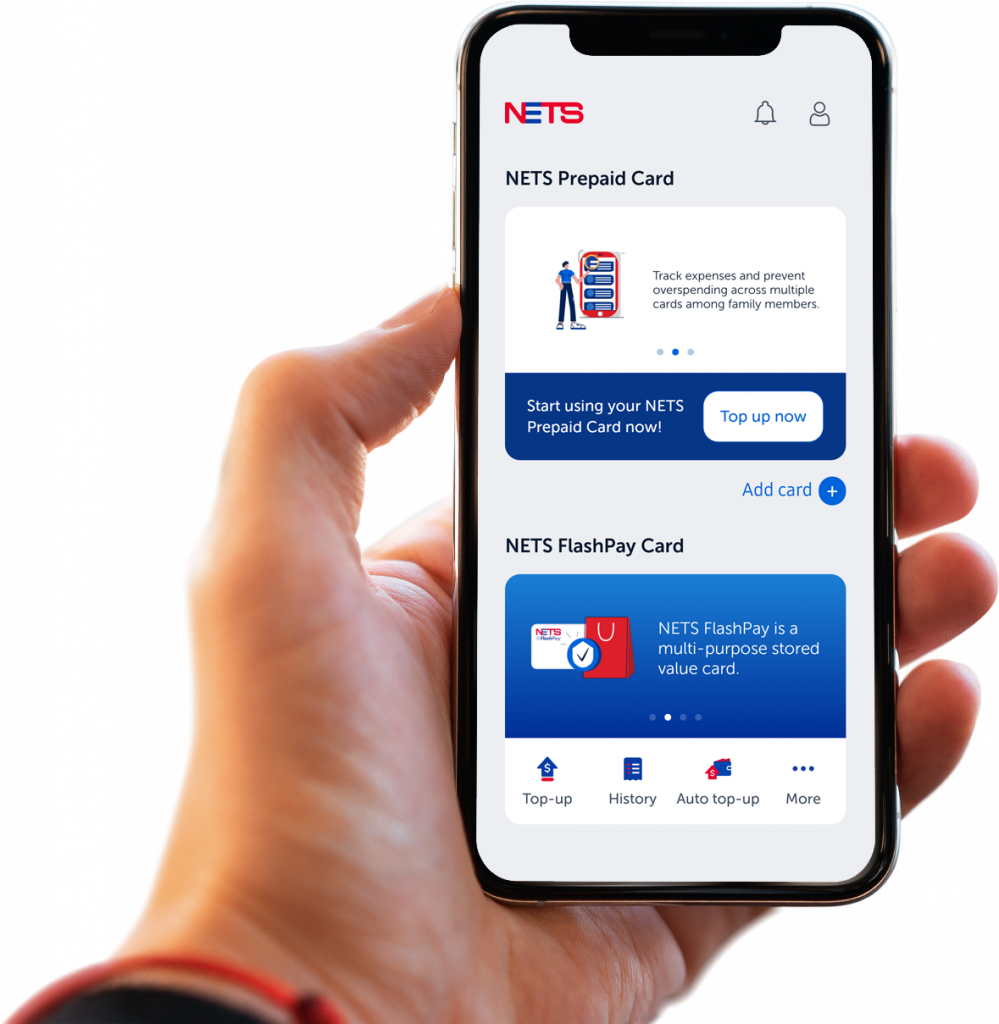

How do I pay when travelling overseas?

Use your mobile bank apps to scan QR code of overseas merchants to make payments.

Use your DBS/POSB, OCBC and UOB NETS Bank Cards issued in Singapore to make overseas payments.

Locations

Start using NETS when you travel to these countries

QR code payments

via bank apps

Scan DuitNow QR via

NETS Bank Card payments

DBS/POSB, OCBC and UOB NETS Bank Cards

*At selected merchants. Look out for NETS acceptance decal to check if merchant accepts NETS payment

Promotions

QR code payments

via bank apps

Scan PromptPay QR via

QR code payments

via bank apps

Scan QRIS QR via

NETS Bank Card payments

UOB NETS Bank Cards only

*At selected merchants. Look out for acceptance decal to check if merchant accepts NETS payment.

QR code payments

via bank apps

Scan UPI QR via

*At selected merchants, look out for UnionPay QR logo to check if merchants accepts UnionPay payment.

Frequently Asked Questions

Filter by Category

All Questions

Did not find what you were looking for? You can still reach us at the following: